Simplify payment processes with the right payment service provider

Both online or in-store: No business can be done without payment service providers. The experts for cashless payment transactions ensure that cashless and mobile transactions reach the right recipient quickly and securely. It doesn’t matter whether it's a girocard, credit card, customer card or payment app: If you want to offer perfect customer service right through to checkout and avoid purchase cancellations, nowadays, you must offer various payment options. The right payment service provider can help.

What does a payment service provider do?

Companies wishing to offer their customers cashless payments needed a reliable payment service provider to do so. Cashless payment processing professionals are also known as payment service providers (PSPs). At the interface between cash registers and bank accounts, payment service providers ensure the secure, fast and smooth processing of all cashless transactions. These include, for example, bank and credit card payments at the checkout in a store, contactless card payments, mobile payments with a wide variety of smartphone payment apps, online payments in webstores, as well as installment or invoice purchases and their digital variant Buy Now Pay Later (BNPL).

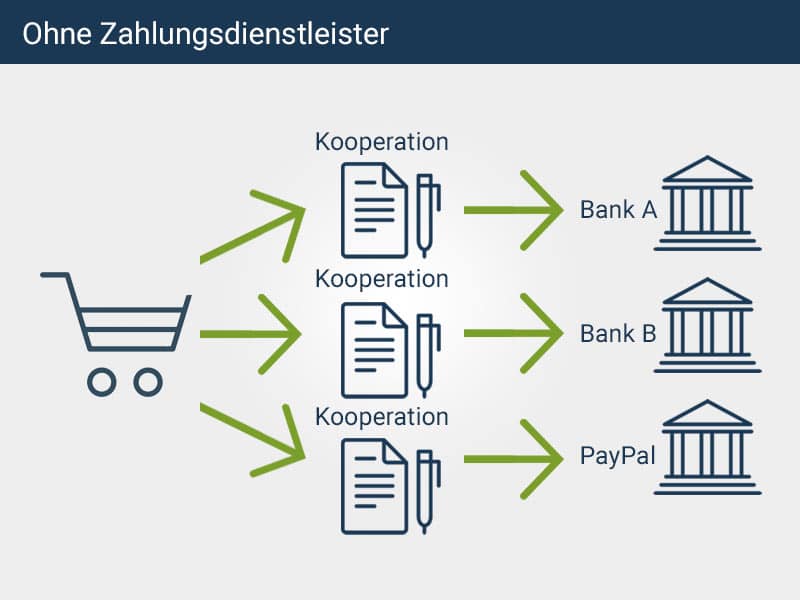

What are the advantages of working with a payment service provider?

The payment service provider provides you as a contractual partner with various payment methods from a single source. With minimal organizational effort and only one contact person, you can thus offer your customers maximum freedom at checkout. Regardless of the sales channel: The payment provider ensures that every customer can choose their preferred payment option from a wide and up-to-date mix. An important service that ensures sales and customer loyalty: Numerous surveys show that customers turn around and leave the store or do not visit it at all if they cannot pay the way they want. Even in online stores, a lack of attractive payment options often leads to the purchase being abandoned.

Is it safe to work with a service provider?

Yes, payment transactions are a matter of trust! Sensitive customer or payment data must not fall into the wrong hands. Purchase amounts, refunds or commissions should go to the correct account quickly and in full. A reputable payment service provider makes your payment transactions more secure. As a professional payment partner, it protects you and your customers from unpleasant surprises and offers you

- Credit checks Payment service providers like secupay process millions of payments every year. The data is incorporated into meaningful credit checks and risk analyses. Real-time queries minimize the risk of non-payment due to lack of account coverage or fraud.

- Payment guarantees If, in rare cases, a payment default does occur, payment providers such as secupay offer payment guarantees for various payment methods.

- Legally compliant processesNumerous requirements must be observed in payment transactions, e.g. the EU Payment Services Directive PSD2 or the General Data Protection Regulation (GDPR). A good payment service provider keeps an eye on changes and offers innovative payment processes that always comply with legal requirements without neglecting customer convenience.

Does a payment service provider need a BaFin license?

Yes, anyone wishing to provide payment services for their customers in Germany is subject to the Payment Services Supervision Act (Zahlungsdiensteaufsichtsgesetz – ZAG) and requires permission from the Federal Financial Supervisory Authority (BaFin). In addition to the processing of card payments, direct debits or credit transfers, so-called money transfer transactions are also among the payment services requiring authorization. Anyone who pays out customer funds as part of cashback promotions may be engaging in a financial transfer business that is subject to prudential supervision. Without a BaFin license, there is a risk of being fined.

How do I find the right payment service provider?

The right payment partner enables you to make straightforward, cost-effective payments across all sales channels. In addition to favourable fees and cost-optimized billing and payout modalities, the fast and easy connection of your cash register and checkout landscape as well as the payment mix offered make up important selection criteria. Easy access to customer and payment data, for example via a digital retailer portal, personal contact persons, high-performance IT that complies with data protection requirements, and reliable technical support are also strong reasons in long-term cooperation. Finally, a technically innovative payment service provider actively supports its clients' growth strategies, for example, with customized innovative payment solutions or by incorporating individual bonus and loyalty programs.

Are you looking for a reliable, experienced partner for your payment transactions? Then test our promise: Simple. Secure. Payment.