Crowd investing solutions

Crowd investing: One company, many investors

As a contemporary, digital form of corporate financing, crowd investing makes it possible to raise debt capital outside the institutional sector via an online platform or a dedicated issuing site. With secupay's services, you as an issuer or platform operator offer potential investors a convenient way to participate in promising financing projects. Funds provided are managed through insolvency-proof escrow accounts in compliance with ZAG and disbursed according to project specifications.

Individual payout plans and automatic consideration of fees and commissions through payment splitting

Automated interest and principal payments via API or eTerminal

Onboarding

Start financing projects quickly and easily

- For project initiators: All required data and identification documents are automatically transferred to secupay via API. After successful testing, we activate the new project for investors.

- Video-Ident for investors: If desired, we can also automatically identify investors during the financing phase on the basis of defined criteria (e.g. amount invested) – seamlessly integrated into your checkout process via Video-Ident.

Payment or repayment

Disbursement or reversal after completion of the financing phase

Once the agreed disbursement requirements have been met and the target amount has been collected in full, the sum must be disbursed promptly to the initiator of the respective financing project. secupay supports the disbursement in one sum or also in several partial amounts. Commissions and fees for stakeholders, for example, your share as a platform operator, are automatically settled and paid thanks to payment splitting. And if a project is not fully financed, secupay pays back the existing funds to the investors.

Interest & principal payments

Reliable service until the last instalment

If a crowd-investing project is successful and the financing amount is paid out to the initiator, the interest and redemption phase follows. With secupay, you offer users of your platform reliable service right up to the last instalment. We support you in ensuring that interest and redemption payments are always received in the correct amount and on time in the investors' accounts. Automate payment flows via API or use the convenient secuOffice portal to instruct payments individually or as a package.

Automation of investment processes

Simple payment of capital gains tax (KapESt) through secupay

The Annual Tax Act 2022 (JStG 2022) will lead to changes for crowd investment platforms with regard to how capital gains tax is handled: Since the turn of the year, payment service providers such as secupay have been paying the tax, including the solidarity surcharge and, if applicable, church tax, to the tax office as part of the statutory obligation on interest payments.

You can read the background to capital gains tax in the crowd investment sector and how we can support you in paying it here.

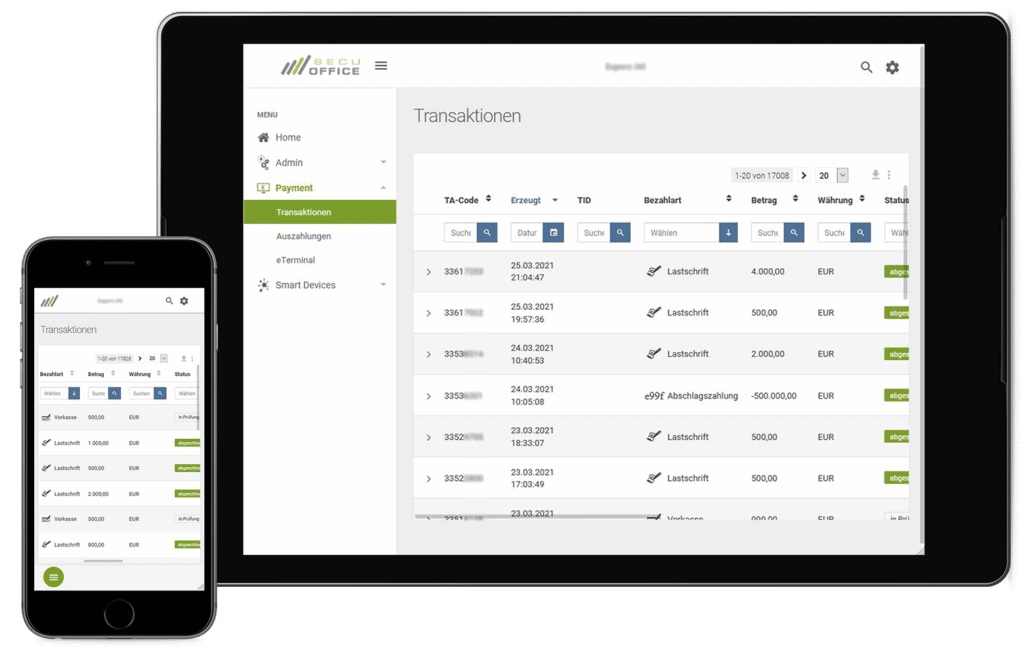

Data portal

All projects at a glance

In the secuoffice online portal, you will find all relevant information such as incoming payments, account balances, disbursement criteria or budget billing schedules clearly prepared for each project on your platform. Role-based access rights give users insight into their data and enable them to independently carry out transactions such as cancellations, interest or redemption payments. Via API, the data from the portal can be conveniently exported to other systems for further processing. Alternatively, you can also integrate display and evaluation functions from secuoffice there.

Smart API for crowdfunding

API integration

Secupay's convenient crowdfunding services can be seamlessly and almost intuitively integrated into your platform via API. We provide developers with our descriptive online documentation with case studies and libraries. For all technical questions, our support team will assist you quickly and competently.

Javascript integration in 3 steps

<head>

…

<link rel=“stylesheet“ type=“text/css“ href=“https://checkout.secupay.com/assets/css/secupay-checkout.css“>

<script type=“text/javascript“ src=“https://checkout.secupay.com/assets/js/secupay-checkout.js“> </script>

</head>

<head>

<!– … –>

<script type=“text/javascript“>

secupayCheckout.setOptions({

contractId:

„GCR_WA66JUP62PNVHBHCXA57PRUNKZP0P5“,

intent: „order“,

isDemo: true,

merchantUrls: {

url_success: „https://shop.example.org/survey“,

url_failure: „https://shop.example.org/basket?msg=HELPLINE“,

url_abort: „https://shop.example.org/basket?msg=VOUCHER“

}

});

</script>

</head>

<script type=“text/javascript“>

function buttonHandler() {

secupayCheckout.setBasket([

{

name: „MeineStadt Gutschein „,

price: 3500,

quantity: 1,

tax: 0

},

{

name: „Glückwunschkarte“,

price: 295,

quantity: 1,

tax: 19

}

]);

secupayCheckout.enterCheckout();

}

</script>

Electronic securities are efficient, cost-effective, and facilitate market access. Strong partners ensure rapid growth.

How European crowdfunding platforms benefit from the new European licence for cross-border crowdfunding projects

References

Project and corporate finance

Invesdor Group

The payment provider secupay manages cross-border payment flows for the crowd payment platform Invesdor: Fundings, repayments and interest payments.

Portagon

The Portagon software solution is distributed with an embedded payment interface. The company was looking for a payment service provider that also has expertise in crowd investing.

bettervest GmbH

bettervest supports sustainable projects in Africa on its crowdinvesting platform. secupay takes care of payments in, payments out, interest and repayments.

biddz GmbH

Shares in new songs can be purchased via the biddz.io platform. secupay is responsible for processing the payments between the stakeholders.

How can we support you?

Send us a message and we will get back to you as soon as possible.