Zahlungsdienstleister für JTL Payment

JTL Payment with secupay: popular payment methods, top rates, easy handling - customised to JTL merchandise management.

Fraud prevention, payment guarantee or data via German data centres - with our JTL Payment Plugin you get more payment security.

Personal contact without being put on hold: over 97% of our customer calls are answered directly. The secupay team is looking forward to your JTL project.

Whether you want to operate a JTL online shop or a JTL POS cash register system - with the payment service provider secupay you have an omni-channel capable payment provider at your side.

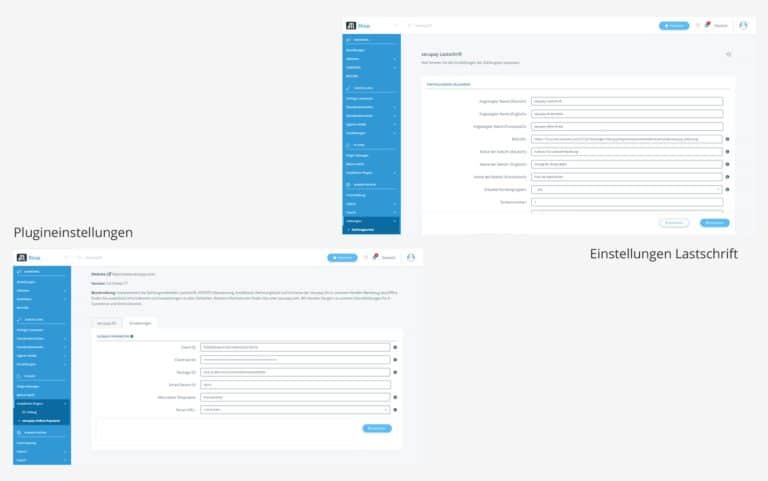

You can install our JTL payment plugin with just a few clicks. The payment plugin is perfectly harmonised with JTL merchandise management and is therefore easy to use.

Our payment methods for JTL shops

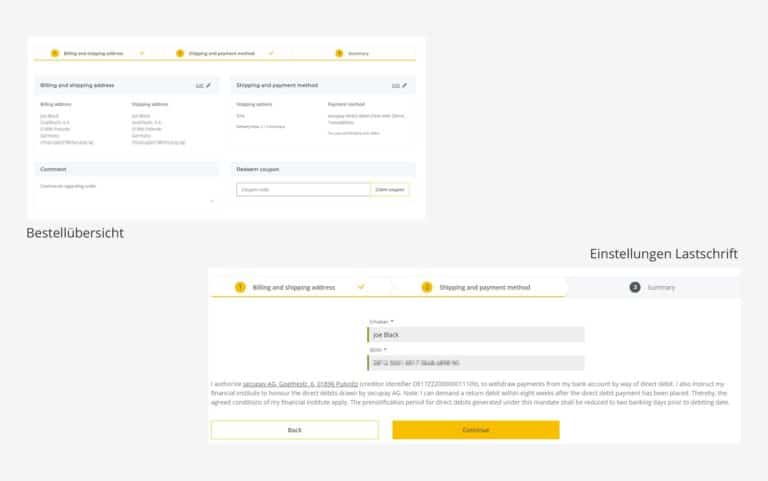

With secupay you can offer preferred payment methods in your JTL shop and avoid payment cancellations in the checkout. Our payment methods:

- PayPal (from JTL5)

- Purchase on invoice

- Credit card payment

- Direct debit

- Prepayment

- Google Pay

Secure JTL Payments

Benefit from our many years of expertise as a payment service provider: as part of our tried-and-tested fraud prevention system, an automated risk analysis is carried out in real time for every payment, in line with our motto: simply pay securely. We also offer a payment guarantee for payments by direct debit and purchase on account. When using our JTL payment plugin, you can also rely on absolute data security, partly due to the German server infrastructure.

Personalised support

Over 97% of our customer calls are answered directly and do not end up in a long telephone queue, according to internal statistics in July 2023. We are there for you: on the phone, by e-mail or in person. The secupay team looks forward to hearing from you and will be happy to advise you in German.

Payment processing, including Omni Channel

The complete package for JTL shops

Benefit from our product diversity. We are there for you across all channels, regardless of whether you want to build a JTL online shop or use a JTL POS system at the POS - with secupay you receive payment services from a single source.

Both the payment plugin for online shops and our card readers for POS use contain many additional features for greater payment convenience for your customers and simple payment processing for you as a shop operator.

Customer loyalty

Customer loyalty programmes and payment processing from a single source: With our JTL payment plugin, you can also use products from our loyalty division secucard. secucard includes many voucher and loyalty programmes that can be individually adapted to your business: For example, customers have the opportunity to collect a bonus with every purchase, which they can redeem on their next purchase. Another advantage is that our programmes can be used cross-channel - for example, your customers can redeem a JTL voucher both in the online shop and at the POS.

Easy handling

You can install our JTL payment plugin in just a few clicks. The subsequent onboarding process is also straightforward thanks to the web-based identification process via the secuOffice merchant portal. The JTL payment plugin supports status updates for orders. Shipping notifications, cancellations and refunds can be made directly from the JTL Wawi. The plugin then automatically synchronises the orders with secupay. You also save time when creating invoices for purchases on account, as the transfer data for the customer is automatically added to the invoice.

More advantages

The secuOffice merchant portal gives you an overview of payments at all times, whether through summarised reports or detailed information on individual payment transactions. This allows you to quickly identify potential and further expand your business.

The secupay payment plugin supports convenient 1-click payment, i.e. the reuse of previously entered payment data - for a simplified payment process for subsequent purchases and more conversions. You can also ensure a smooth shopping experience with our smart exemptions from two-factor authentication, such as TRA* and LVP** exemption for credit card payments.

Whether you run a start-up e-commerce store or a large online retailer – our Tariff models are tailored to your needs.

Contact us

From Monday to Friday between 9 am and 5 pm at

+49 (0) 35955755010.

- Activation

- Valuation transaction risk

- Velocity checks

- White- & blacklist queries

- No minimum contract periods

- No hidden costs

Service fee per month

Transaction fee

- 1,95%

- 0,95%

- plus 1.00% discount

Service fee per month

Transaction fee

- 1,45%

- 0,80%

- plus 1.00% discount

Service fee per month

Transaction fee

- 0,95%

- 0,60%

- plus 1.00% discount

- Surcharge credit cards without MIF regulation: 1.3 %

- All prices are subject to the statutory value-added tax.

- Surcharge credit cards without MIF regulation: 1.3 %

- All prices are subject to the statutory value-added tax.

About the JTL-Shop software

Developed in Germany by a brother and sister in 2008, the JTL shop system offers retailers many useful functions for more flexibility when designing their online shops. A particular favourite: JTL-WaWi, the software includes a free merchandise management system. Anyone who wants to combine stationary and online retail is in good hands with JTL, as the manufacturer also sells its own POS systems for use at the POS.

- Scripting language: PHP

- Costs: Free & paid (Community, Standard, Professional & Enterprise Edition)

- Provider: JTL-Software GmbH

- Origin: Germany

- Foundation: 2008

- Market share in Germany:

Under 2% (as of 2018)

We look forward to your JTL project

Contact us

Von Montag bis Freitag sind wir gern telefonisch für Sie da.

Sie erreichen uns zwischen 09.00 Uhr und 17.00 Uhr unter

+49 (0) 35955 75 50 10.