Fast, simple and customer-oriented

Your payment provider with a straightforward onboarding process and KYC

Your start with secupay is so easy

Easy contract signing and activation as well as KYC process

When working with a payment service provider, a smooth and speedy onboarding process is particularly important. This includes simple contract conclusion, KYC process and fast contract activation. To simultaneously prevent money laundering and terrorist financing, the legislator requires identity verification of users of payment services and online platforms. This commitment is also known as the Know Your Customer process (KYC) or Customer Due Diligence process (CDD).

With the help of a completely web-based onboarding process, secupay takes care of all checks, in compliance with the necessary legal requirements.

Fraud management

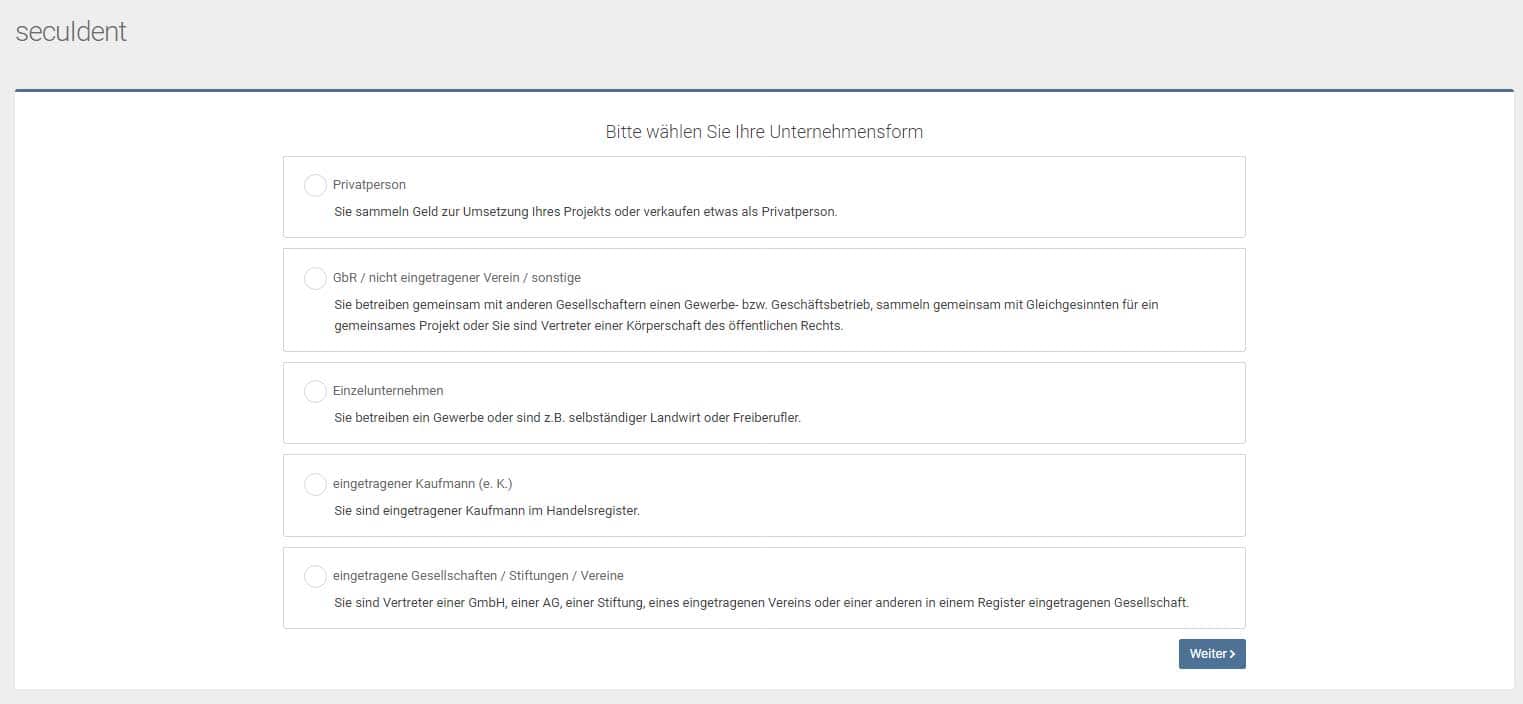

Simple KYC process with secuIdent

Uncomplicated identification in accordance with the Money Laundering Act

With "secuIdent", secupay has created an online tool to identify contractual partners that meets all legal requirements and enables a fast, simple and secure KYC process.

All necessary details and documents are compiled in a web-based application and checked by our KYC team.

After successful verification, your contract will be activated for the receipt of payments.

Fast integration

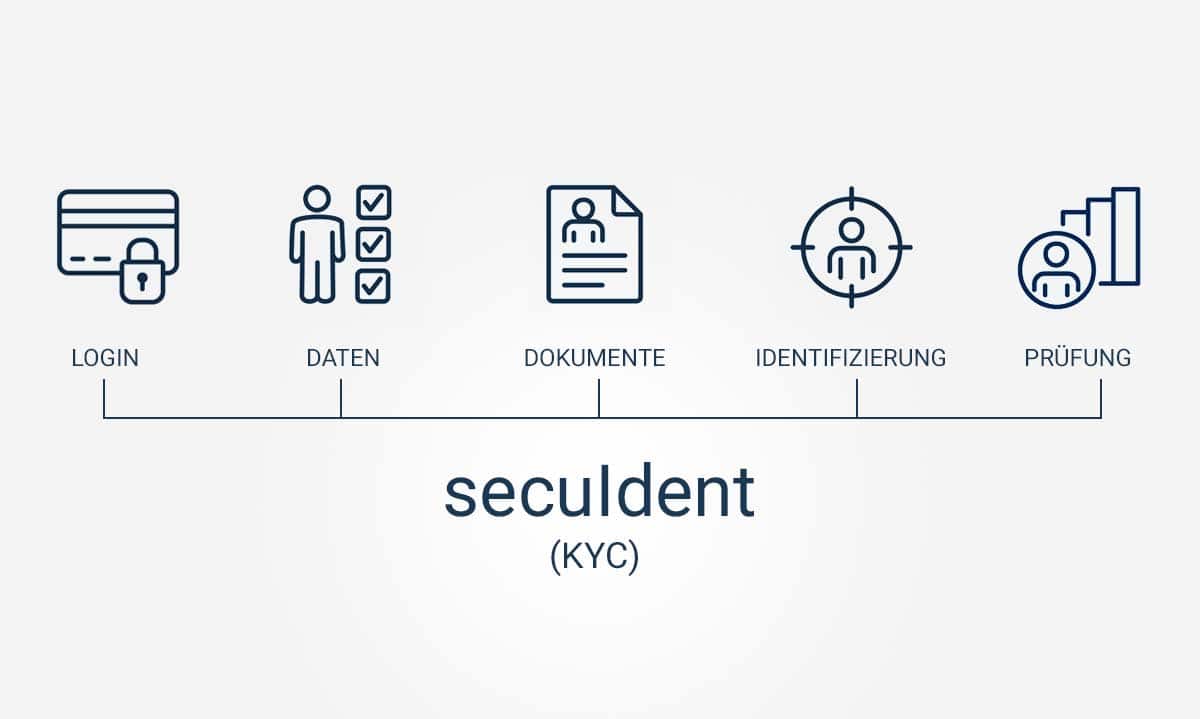

This is how easily the web-based onboarding process works

Log in to your secuOffice account and use secuIdent

Provide your details of the contracting party and beneficial owner

Upload all necessary documents

Select your desired identification method

Identify customers with little effort

You have customers who have already been identified in accordance with the GwG?

If the identification was carried out by an obligated party under the GwG, they can confirm the identification to us.

- You create an identification process via API

- You submit the identification data

- secupay checks the identification

- secupay activates the payment services for this customer

Identification in just a few steps

You want to carry out the identification as part of your own onboarding?

If you are an intermediary, technical service provider or platform operator and your customers have to conclude their own payment service contracts with secupay, the identification can also be integrated on your platform or in your app.

- You create an identification process via API

- The identification is carried out and checked

- secupay activates the payment services for this customer

All advantages at a glance:

- Low effort thanks to uniform, web-based recording of necessary user data

- Efficient collection of the necessary identification documents

- Compliance with all legal regulations - with an uncomplicated onboarding process and KYC

- Provision of a simple identification process for higher conversions and lower abandonments

- Simple, fast and secure online

- Shortened processing times for contract partner identifications and contract activations

Your expert team

Ready to go?

Contact us or start your personal onboarding process directly