Online Payments

The payment service provider for e-commerce

Improve your online business with the customer-optimized and mobile-friendly payment solutions from the payment service provider secupay. Whether quick and easy with preconfigured shop modules, or complex and individual with API connection: the seamless integration of secupay payments into your online shop or your platform supports you in optimizing your online business and generating more sales.

Payment methods

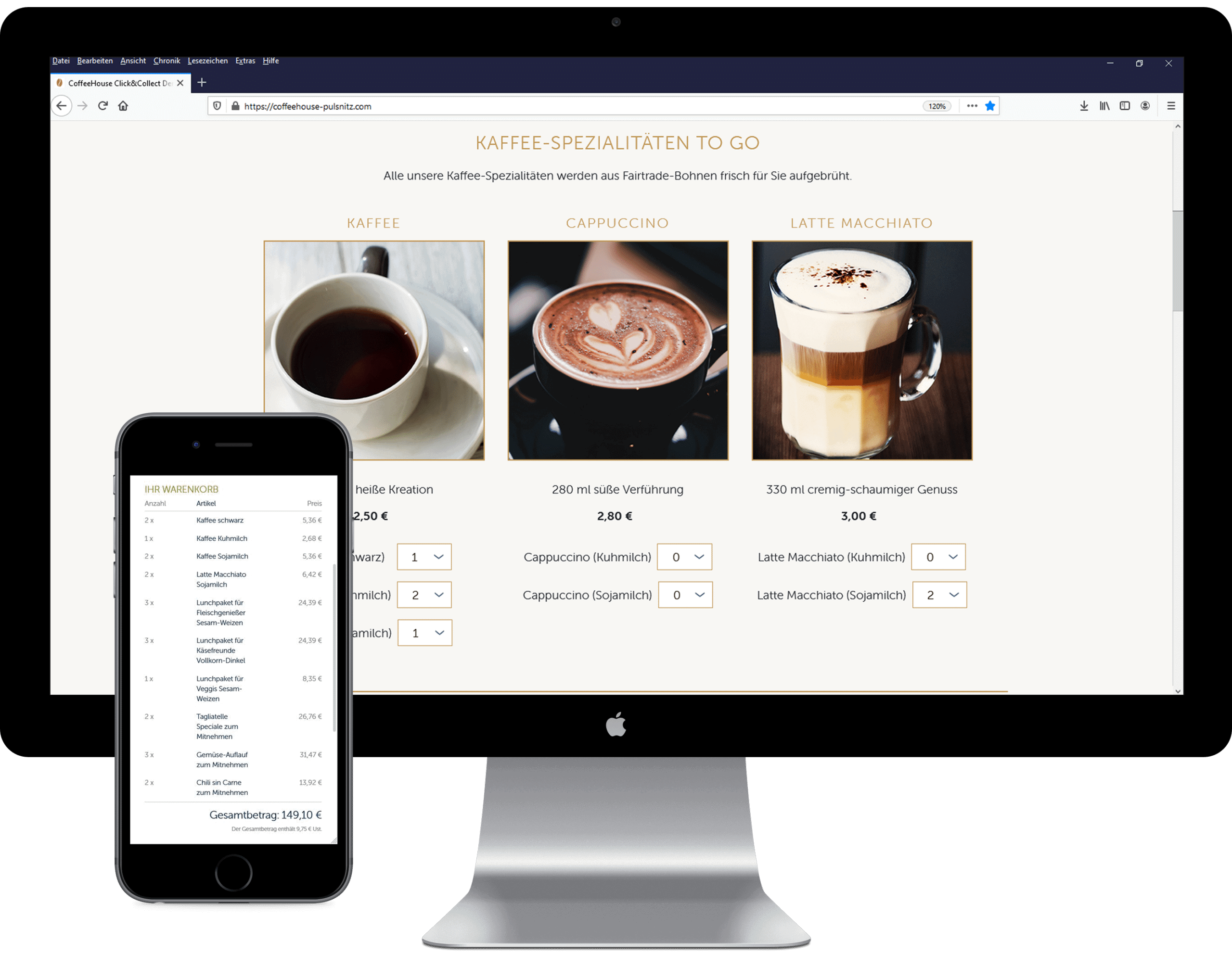

Offer the optimal payment mix with payment methods your customers prefer, seamlessly and mobile-friendly – with a loyalty programme integrated into the checkout process if desired.

Integration

Save integration costs by using our numerous store modules or our SDK. Integrate the secupay payment solution quickly and easily into your online store, website or platform.

Payment security

Protect yourself from non-payment. Secupay fraud prevention performs real-time risk analyses for each transaction. The secupay payment guarantee protects against subsequent defaults.

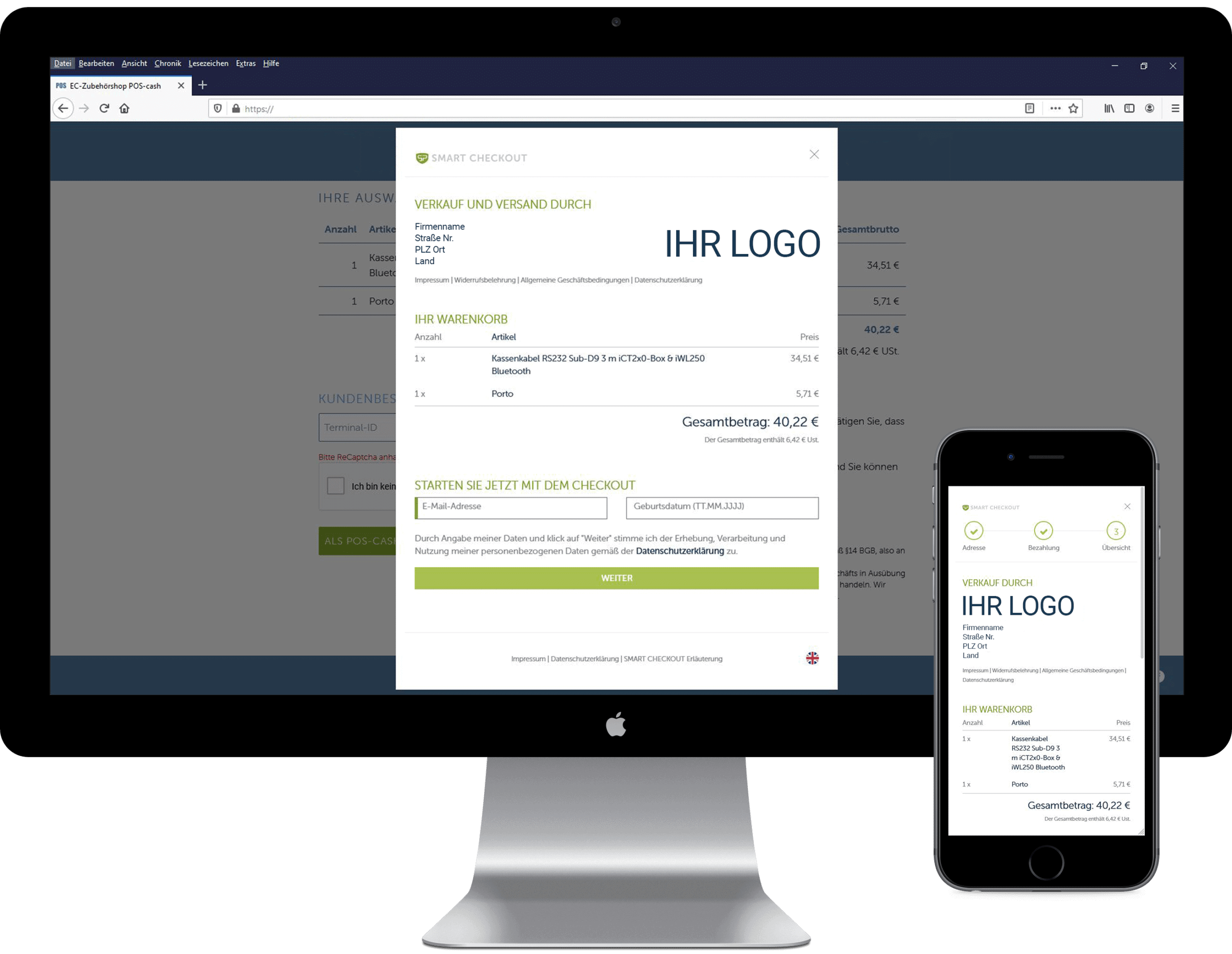

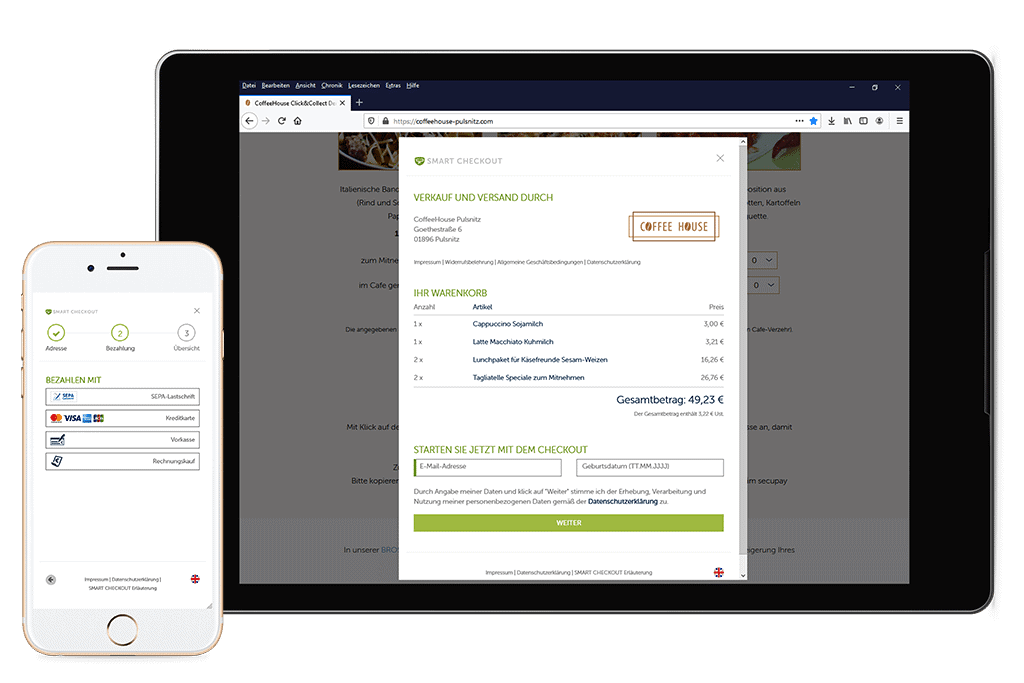

Smart checkout

Checkout even without a store system with secupay Smart Checkout. All payment methods and functions are combined in one complete checkout solution hosted by us.

Online payment methods

Payment methods your customers want

Choice is important – not only in the store but also at checkout. Avoid abandoned purchases at the checkout by offering your customers their preferred payment methods, such as SEPA direct debit and purchase on account.

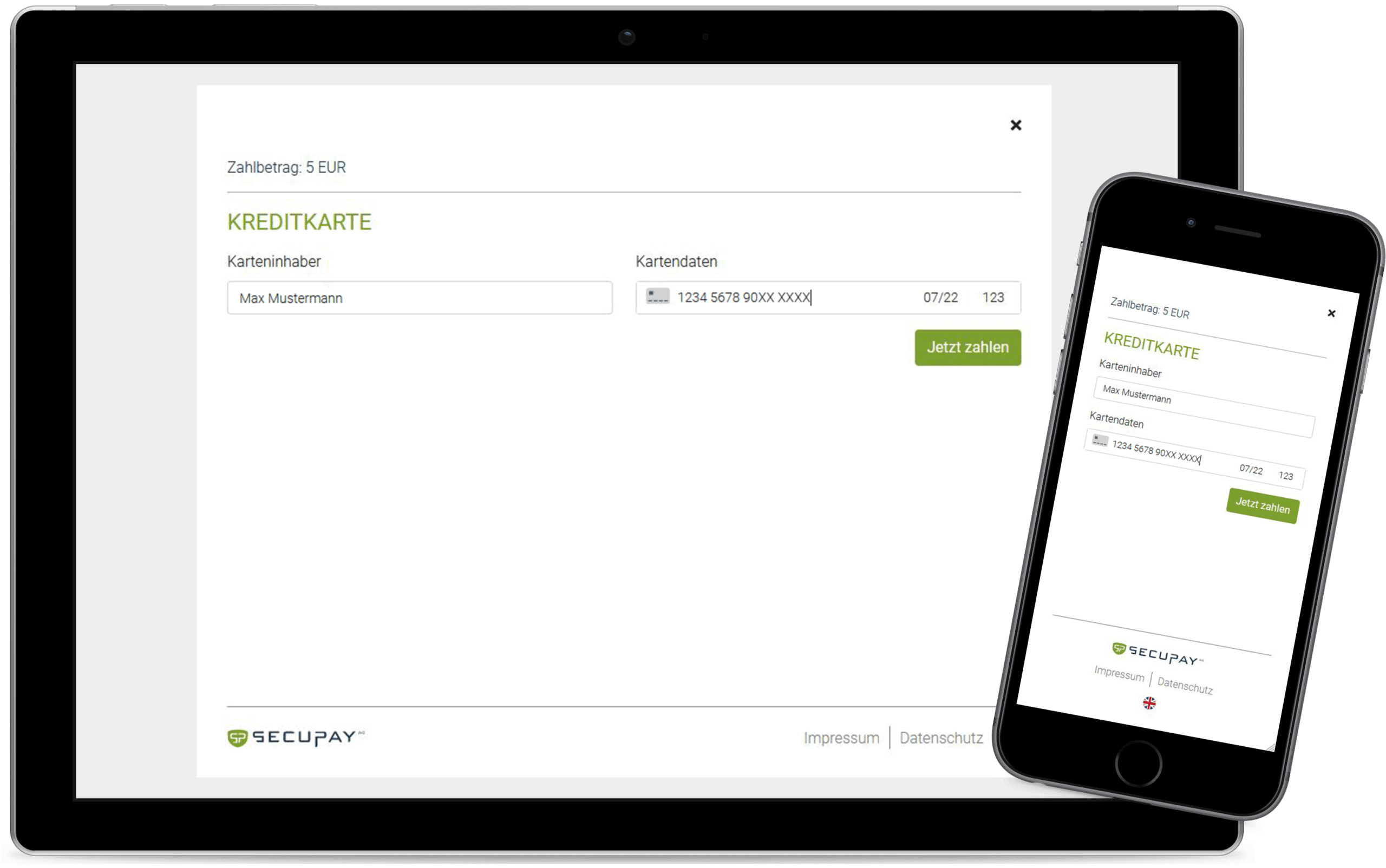

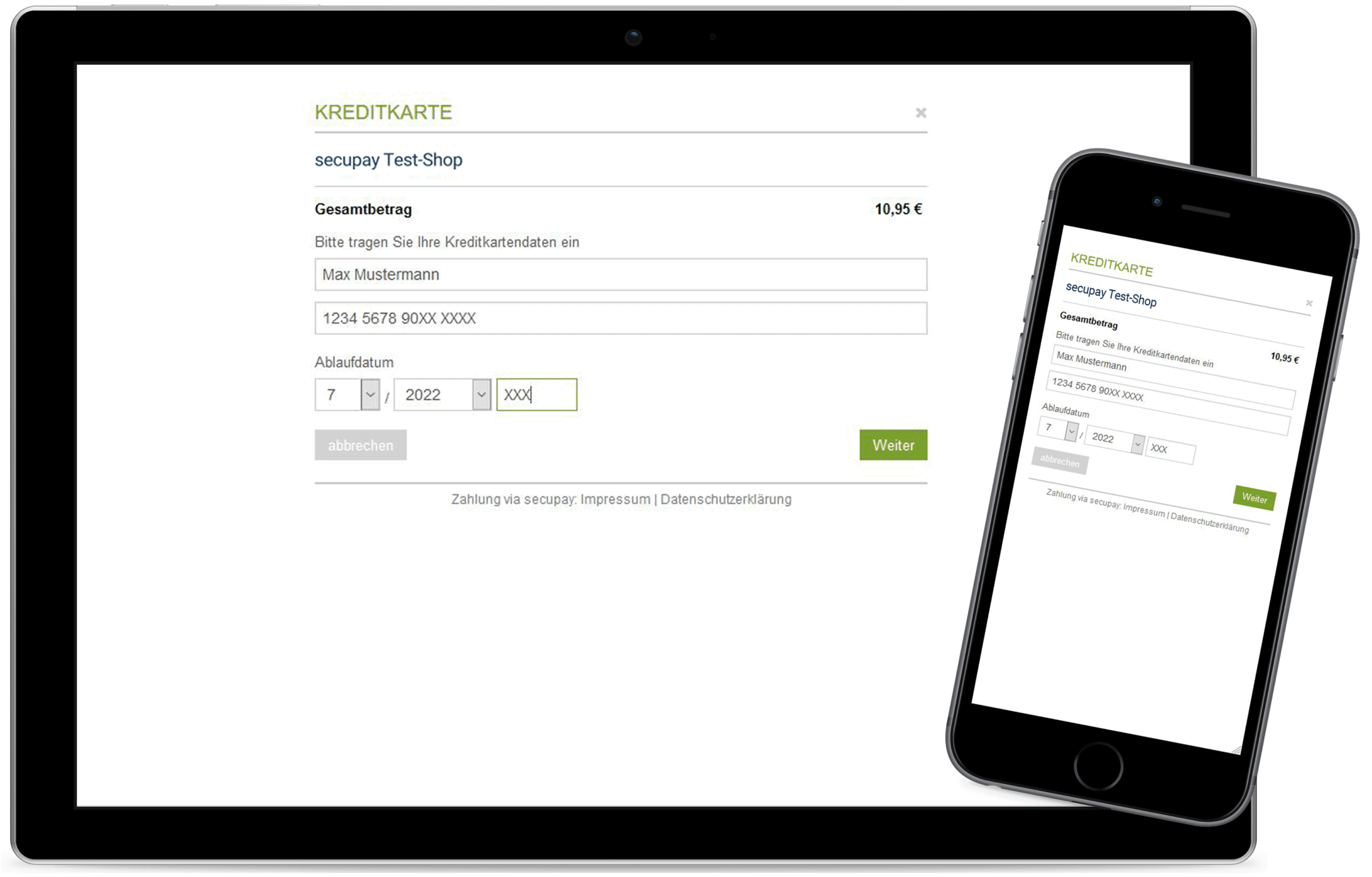

Credit cards

- All relevant debit and credit cards e.g. VISA, Mastercard, AMEX, Unionpay, Diners, JCB

- Tokenization and recurring payments, also with flexible payment amounts

- Chargeback protection and settlement

SEPA Direct Debit

- Order for direct debit collection after order or on the desired delivery date

- Recurring payments, also with flexible payment amounts

- Return debit processing, if desired with customer communication and hope run

Purchase on invoice

- Payout when due

- Automatic assignment of incoming payments to the respective orders

- End customers can also pay the invoice using a payment link or QR code

- Also suitable for B2B

- Including risk and receivables management

Prepayment

With push notification upon receipt of payment, payment is triggered via:

- QR code to scan from the banking app

Installment payment

- Simple and fast integration via API

- Shipping as payment link enables online instalment payment without your own online store

- Uniform reporting in secuOffice

Of course, we also offer PayPal in Smart Checkout and „Payment Wizard“ , and for high-transaction customers, we also offer services such as collecting and reconciliation. In addition, we offer many other payment methods in the project business upon request.

ALIPAY • BANCONTACT • DINERS • Przelewy24 • IDEAL • MAESTRO • PAYPAL • PAYDIREKT • POSTFINANCE • POSTCARD • TWINT • VPAY • MASTERPASS

We help you effortlessly implement your optimal payment mix. Fast, economical and reliable.

Your retailer logo on the transaction overview of your customers

The payment provider for eCommerce

Secupay offers online shops innovative and easy-to-integrate payment solutions. See the short film to find out more.

Secure your sales and reduce risk

secupay offers comprehensive services to assess the risk of a transaction during the payment process, for example, to identify and prevent fraudulent intentions. If a payment default still occurs after the order has been completed, this can be covered for payments by direct debit and purchase on account through the secupay payment guarantee.

Provide your customers with streamlined payment forms to enable smooth checkout.

Our store modules seamlessly integrate the optimal number mix into the front and backend of all common online shop systems.

Even without an online store system: our Smart Checkout complete solution from a single source.

Choose flexible forms of integration, according to your needs

As a payment form or a complete checkout solution – secupay's customer-oriented optimized payment solutions provide you with the best possible support for your business. The continuous ongoing development of our products ensures that we provide you with precisely tailor-made solutions. Offer your customers the optimal number mix and improve your conversion rate.

Our store modules seamlessly integrate the optimal number mix into the front and backend of all common online shop systems.

Provide your customers with streamlined payment forms to enable smooth checkout.

Auch ohne Online-Shopsystem: unsere Smart Checkout-Komplettlösung aus einer Hand

Turn our strengths into your advantages

-

Quick purchase with every customer contact

With secupay payment and checkout solutions, you can offer your customers short paths from the purchase decision to order completion. -

Conversion optimization

ntelligently managed strong authentication (2FA) exemptions such as TRA* and LVP** Exemption support frictionless shopping experiences.

*TRA = Transaction Risk Analysis

**LVP = Low-Value Payments -

Recurring payments and subscriptions

Manage payments for subscriptions even with variable payment amounts via the secupay interface using tokenized payment data or with equal payment amounts via our subscription management. Subscription bzw. Abo Management.

-

1-click solutions

Our new store modules support the reuse of payment data once entered and enable one-click payment. -

Intelligent security mechanisms for traders

Benefit from the integrated credit check and risk assessment (fraud prevention) to avoid payment defaults for invoice and direct debit purchases. -

Automation of complex payment processes

Functions such as mixed baskets, payment splitting and payouts form the basis for automating payment transactions even for complex business processes.

Manage incoming payments

Payment reconciliation included: Thanks to automatically assigned cash receipts to transactions in the secuoffice merchant portal as well as in your online store backend, you will have a complete overview at all times. Make cancellations directly online, submit credit notes, or file shipping notifications. All functions can also be integrated into the customer's own systems via the secupay interface.

Additional business without additional effort

Secucard: The omnichannel solution for your gift card sales

Enable your customers to buy and redeem gift cards across channels

We protect your data and the data of your customers

-

Certified security:

Annual proof of compliance with the specifications of the PCI DSS industry standard with regard to technical and organizational requirements for the protection of payment data -

Protected communication:

For the highest confidentiality and integrity of your data, we use current and strong encryption mechanisms (TLS/SSL) -

Multilevel defence systems:

Data is comprehensively protected against loss, manipulation and unauthorized access through the use of security measures and multi-layered defence systems - secupay AG (payment institution register no.: 126737) is supervised by the German Federal Financial Supervisory Authority (BaFin).

Knowledge

Our e-commerce guide

Subscription commerce: Loyalty has a future

Online subscriptions provide the opportunity for stable customer loyalty, calculable cash flows, and attractive additional sales through cross-selling and up-selling. Suitable payment features are important.

Apple Pay and Google Pay: a powerful duo for online shops

Easily integrate the payment methods Google Pay and Apple Pay into your online shop and increase conversions with the payment service provider secupay.