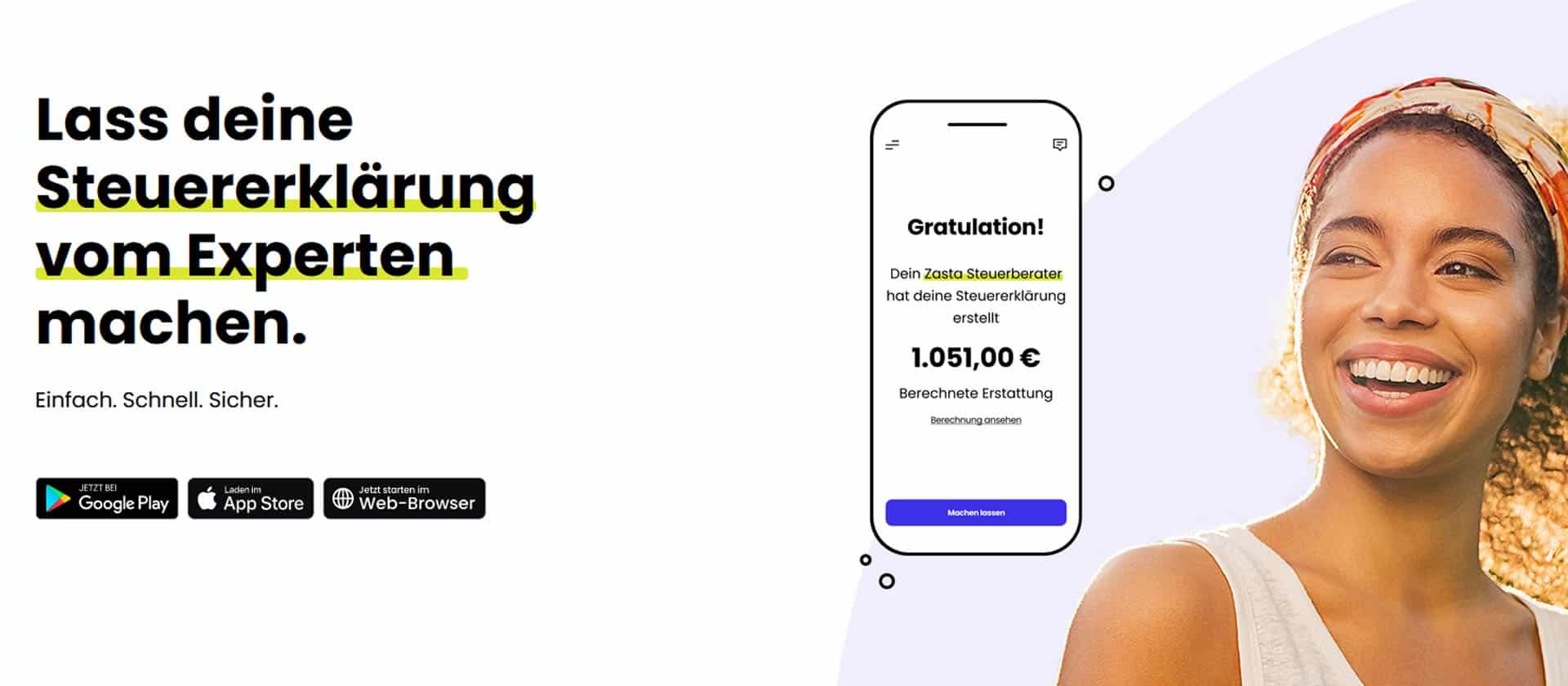

Automated Collecting Services for the "Zasta" Tax Advisor App

Zasta GmbH

The challenge

Short turnaround times, low onboarding effort including identification and automated payments as well as process scalability are key to taxpayers using Zasta's digital tax platform for their tax returns and tax advisors enjoying working with Zasta. This requires an automatic and, above all, correct allocation of the constantly increasing number of refund amounts, as well as the possibility to distribute the incoming payments in such a way that the tax-advisor fees are withheld from the pay-out to the taxpayer.

The solution and cooperation

“As a tax return platform, scalability and data security are top priorities for us. In secupay, we have found a professional partner who, through the extensive automation of onboarding and payment processes, enables us to offer a highly innovative digital business model plus security 'made in Germany'."

Michael Potstada, Founder & CEO Zasta

Website: zasta.de

About Zasta GmbH

In keeping with the motto "Tax refund without paperwork", Zasta lets taxpayers check online whether they are entitled to a tax refund and to apply for it via cooperating tax consultants. If desired, the calculated refund amount minus all fees and commissions can even be paid out in advance as a credit. A fee is only due if a refund is made. More than 100,000 customers have already registered in the app. Tax advisors can use the platform as a software-as-a-service (SaaS) to win new clients in an uncomplicated manner and to present themselves as a modern firm.